- Tendepay receives CBK approval to operate as a Payment Service Provider(PSP);

Tendepay, a leading digital payment solution, has received approval from the Central Bank of Kenya (CBK) to operate as a licensed Payment Service Provider (PSP).

This authorisation allows Tendepay Limited to process and settle payments on behalf of merchants, enhancing Kenya’s digital payments landscape.

Tendepay is designed to help businesses streamline their financial operations by digitising their payments, reducing risks of misuse and theft.

The platform empowers enterprises—ranging from small businesses to large corporations—to oversee and control their spending efficiently.

The solution is ideal for microfinance institutions (MFIs), distributors, contractors, logistics companies, accountants and micro, small, and medium enterprises (MSMEs), as well as other organizations managing frequent disbursements.

It offers a secure, automated platform that streamlines financial transactions, enhances oversight, and optimizes business expenditure management.

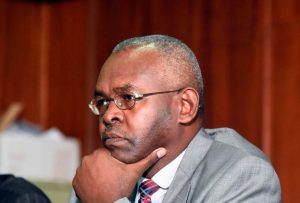

“We are excited to receive this authorisation, which enables us to expand our payment solutions across Kenya. We appreciate the CBK for fostering local fintech innovation and creating an enabling regulatory framework,” said Abel Masai, CEO of Tendepay.

“Tendepay ensures better control, visibility, and accountability through multi-user approval processes while generating comprehensive expenditure reports.”

Founded in 2020, Tendepay offers a robust spend management platform that puts business owners and managers in control. Its suite of digital tools supports petty cash management, bulk payouts, salary processing, payment disbursement, reconciliations, and seamless integration with ERPs and accounting systems.

The platform supports one-off payments, recurring transactions, and subscription services via M-Pesa, bank transfers, and paybill integrations.

It also facilitates bulk payments for casual employees and airtime disbursements.

Managing petty cash has long been a challenge for businesses, with traditional manual methods being time-consuming and prone to errors, mismanagement, and theft.

Tendepay addresses these concerns with a digital-first approach, providing businesses with real-time visibility, multiple approval levels, and automated reconciliation for better financial control.

With mobile money subscriptions in Kenya reaching 39.8 million, according to the Economic Survey 2024, digital solutions like Tendepay offer businesses a seamless and secure way to manage their petty cash and payment operations.