Tende Pay SME commercial lead,Wangui Njoroge

Tende Pay, a payment platform tailored/designed for business operations said it is deploying its platform to empower enterprises of Businesses can now enhance the management of their petty cashby embracing digital payment solutions, helping them improve their operational efficiency, safeguard against potential misuse and theft.

This is after Tende Pay, a payment platform tailored/designed for business operations said it is deploying its platform to empower enterprises of all sizes from small businesses to large corporations, to efficiently oversee and maintain the balance of their petty cash on a regular basis.

“Businesses including SMEs remain the backbone of our economy.Now more than ever, it has become more important for SMEs to assess how to best digitize their businesses which is why we have designed the Tende Pay platform to assist organizations to manage their working capital and improve productivity by digitizing these payments and have visibility over them,” according to Tende Pay SME commercial lead Wangui Njoroge.

Petty cash management is an important aspect of any business, particularly for those who need to make small and frequent payments that are too small to justify writing a cheque.Petty cash management has long been a challenging task for businesses of all sizes. The traditional, manual methods of handling petty cash are not only time- consuming but also prone to errors and mismanagement.

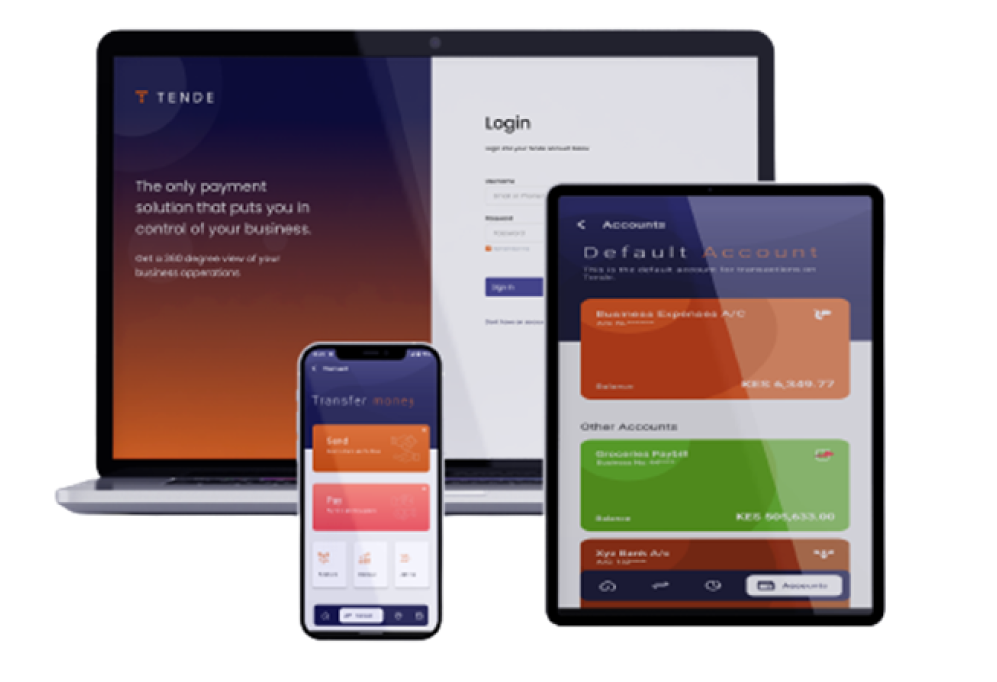

Tende Pay addresses these concerns, offering a comprehensive solution that transforms how businesses manage their petty cash, enabling decision makers to remotely control their business by giving them a 360-degree view of their business operations. The platform also enables business owners or managers to control petty cash payments by providing multiple approval levels.

Tende Pay addresses these concerns, offering a comprehensive solution that transforms how businesses manage their petty cash, enabling decision makers to remotely control their business by giving them a 360-degree view of their business operations. The platform also enables business owners or managers to control petty cash payments by providing multiple approval levels.

”With Tende Pay, the finance director of a company with several branches across the country, for instance, is able to control how petty cash is dispensed. Tende Pay has empowered them to approve in real-time the expenditure of cash petty exceeding a certain amount, say Sh100,000, from a centralized place”she added.

She adds:”If you run a small business as your side hustle in Mombasa and you are working in Nairobi, for instance, you can still be able to manage payments for supplies and the running of day-to-day business through Tende Pay.”Tende Pay facilitates one-off payments, recurring payments, and subscription services through M-Pesa, bank, and Paybills. The solution also enables bulk payments for casual employees or airtime.

”The platform also generates expenditure reports to help businesses to better plan their finances,” says Ms Njoroge.

According to the Economic Survey 2023, mobile money subscriptions in the country stand at 38.6 million—meaning that it is possible to pay petty cash through mobile money services. By March of this year, Kenyans owned a total of 29.5 million smartphones, according to the Communications Authority (CA).

The latest report by the Kenya National Bureau of Statistics (KNBS) shows that over 400,000 micros, small, and medium enterprises (MSMEs)—which create 80 percent of employment in Kenya—hardly survive for two years due to financial mismanagement, poor planning, among other reasons.”Tende Pay can save some of these SMEs affected by financial mismanagement from failing,” said Ms Njoroge.