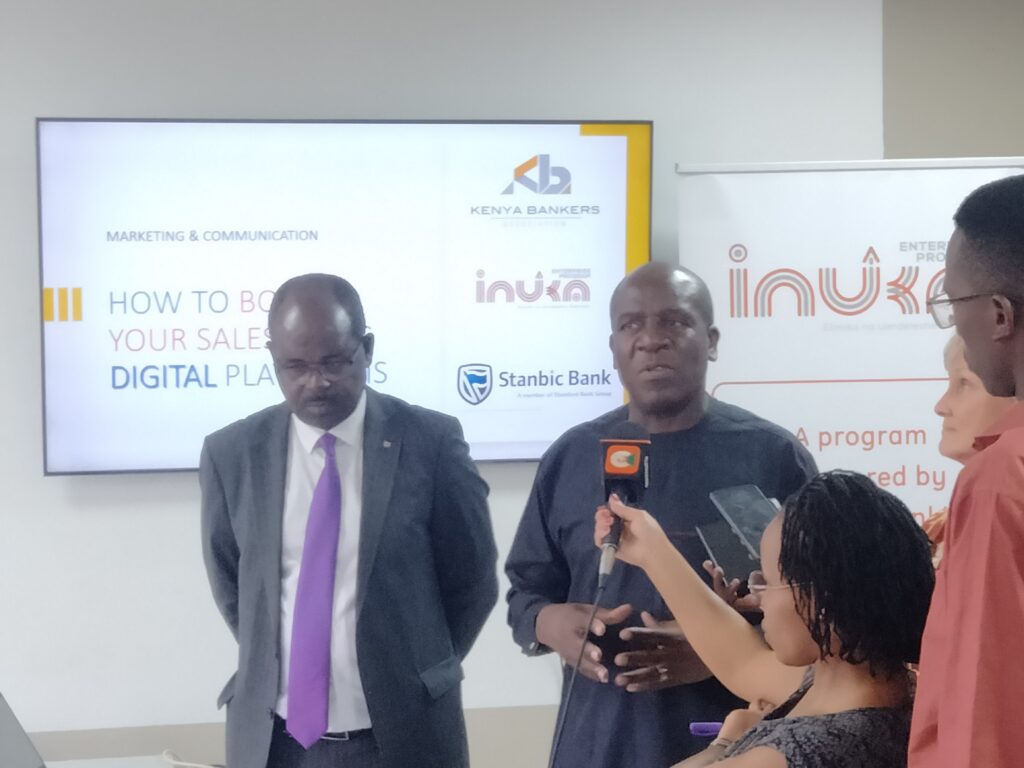

From L-KBA CEO,Habil Olaka flanked by Charles Mudiwa,Stanbic Holdings Plc CEO((R). Stanbic Bank has intentionally driven diversity and inclusivity in its support of financial inclusion initiatives with a focus on SME Growth.[Photo/B.Q}

Stanbic Bank Kenya and the Kenya Bankers Association finalised a month-long financial literacy training for 200 deaf MSME owners enrolled in KBA’s Inuka program. The training, which drew participants from Nairobi, Kiambu, and Kajiado counties, is part of Stanbic Bank’s initiative designed to help entrepreneurs running small businesses strengthen their financial situation and run their enterprises sustainably.

Through the Uwezo Fund and Youth Enterprise Development Fund, the government has been keen on supporting differently abled disabled entrepreneurs to access funds to facilitate the growth of their businesses. In line with Stanbic’s initiative to partner for growth, the bank trained the participants on crucial financial management tips, including managing cash flows, keeping business records, loan management, and understanding profitability.

Stanbic Bank has intentionally driven diversity and inclusivity in its support of financial inclusion initiatives with a focus on SME Growth. Having conducted over 20 training sessions and reaching over 1,300 clients, the bank has enabled individuals, entrepreneurs, and small enterprises to access relevant and affordable financial products and services, including payments, savings, credit, and insurance, enabling them to transact conveniently and cost-effectively, save and plan for the future, and deal with unexpected emergencies. These benefits, in turn, have supported economic development and reduced inequality in the country.