- Safaricom Secures KES 15 Billion Sustainability Linked Loan

The telco has now secured KES 30 billion in its push for sustainability and growth. The investment will be geared towards its ESG agenda.

Safaricom (NSE: SCOM) has secured another KES 15 billion Sustainability Linked Loan, bringing the total loan facility to KES 30 billion having announced the closure of a similar amount last year.

The loan facility which is the largest in the East African region is set to advance Safaricom’s Environmental, Social and Governance agenda (ESG).

The loan facility which is the largest in the East African region is set to advance Safaricom’s Environmental, Social and Governance agenda (ESG).

The funding has been provided by a consortium of four banks consisting of KCB, ABSA, Standard Chartered and Stanbic which will scale up its strategic sustainable investments.

“This deal paves the way for the advancement our sustainability agenda.

“This deal paves the way for the advancement our sustainability agenda.

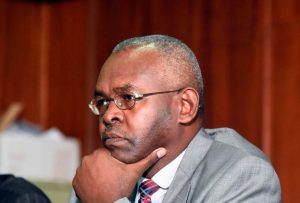

This funding will be channelled towards strategic and significant investments in technology and services which will enable us to unlock our ability to transform lives by elevating our ESG objectives,” said Peter Ndegwa, CEO, Safaricom.

It is expected that the facility will accelerate Safaricom’s transition into a fully-fledged technology company where it seeks to reduce its carbon footprint and enhance its progress on gender diversity and monitoring its social impact.

It is expected that the facility will accelerate Safaricom’s transition into a fully-fledged technology company where it seeks to reduce its carbon footprint and enhance its progress on gender diversity and monitoring its social impact.

It plans to be a Net Zero carbon emitting company by 2050 with programmes put in place to achieve this.

“We are delighted that we have tapped into partnerships with key leaders in the region in the latest chapter of sustainability financing.

“We are delighted that we have tapped into partnerships with key leaders in the region in the latest chapter of sustainability financing.

It will improve our accountability measures on ESG reporting where we will have an opportunity to attract more investment and growth,” added Mr Ndegwa.

“Safaricom is dedicated to making conscious efforts to ensure that our projects and initiatives align with the ESG agenda.

This deal highlights our commitment to sustainability and the inherent alignment of our sustainability and financing strategies,” added, Dilip Pal, CFO, Safaricom.

Standard Chartered continues to act as Mandated Lead Arranger and Bookrunner, Global Coordinator and Sustainability Coordinator for the transaction, while Kenya Commercial Bank acted as Mandated Lead Arranger, as well as Stanbic Bank Kenya and ABSA Bank Kenya who both acted as Arrangers.

Standard Chartered continues to act as Mandated Lead Arranger and Bookrunner, Global Coordinator and Sustainability Coordinator for the transaction, while Kenya Commercial Bank acted as Mandated Lead Arranger, as well as Stanbic Bank Kenya and ABSA Bank Kenya who both acted as Arrangers.