Safaricom PLC Chief Executive Officer (CEO), Peter Ndegwa(C), Safaricom CEO Ethiopia Anwar Soussa(R)and Safaricom PLC Chief Finance Officer, Dilip Pal(L) peruse through the financial results report moments after the 2023- 2024 Financial Year Results announcement at MJC.

- Safaricom earnings hit Kes140billion, becoming the first company in the region to hit past the billion-dollar mark

- The earnings before interest and tax (operating profits) is a measure of how efficient the management has been utilizing investor funds

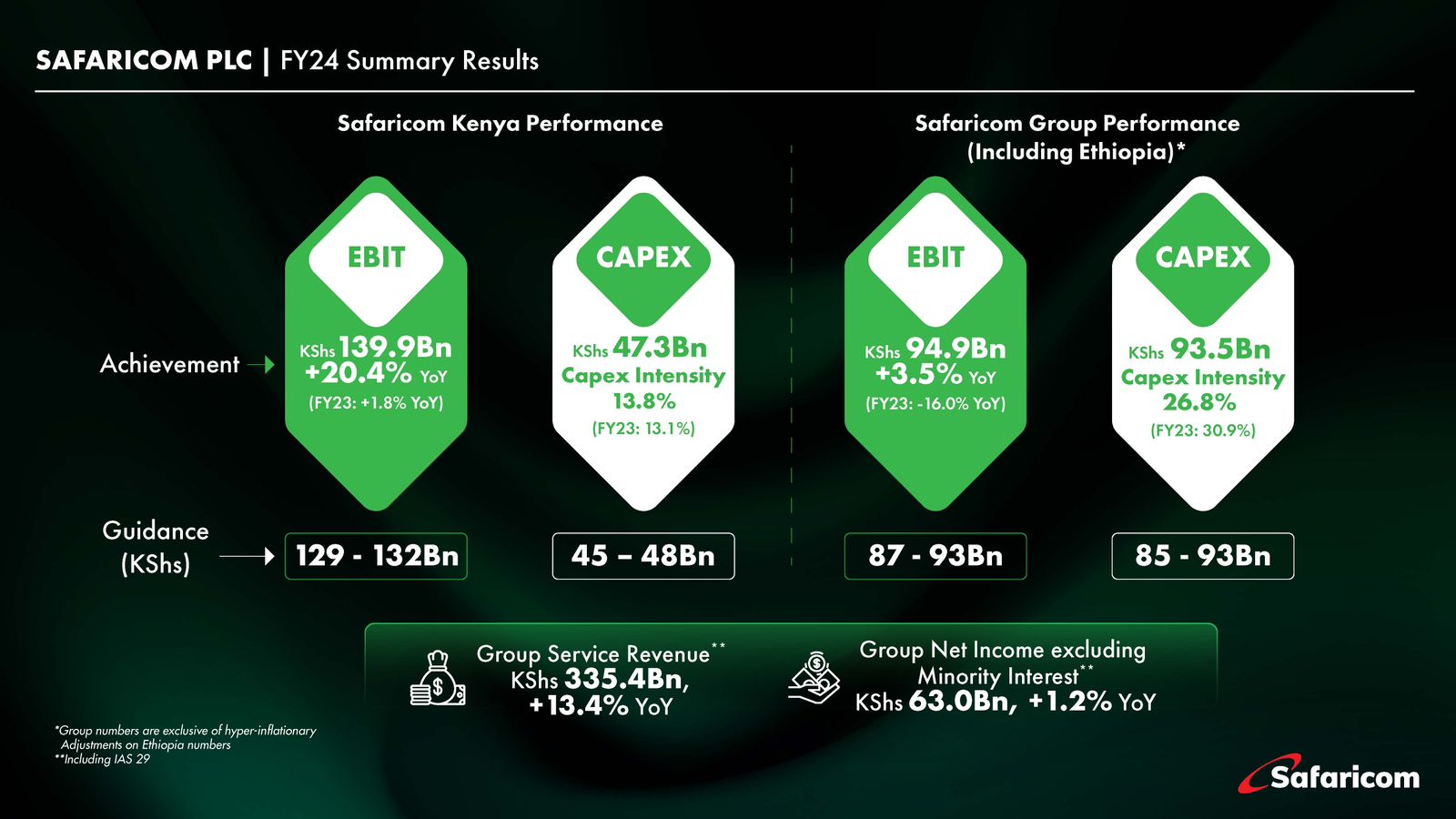

Safaricom (NSE: SCOM) PLC has announced a KShs 139.9 Billion in its earnings before interest and tax in the period ending March 31st 2024.

At a group level, incorporating the startup costs and investments in Safaricom Ethiopia, the group closed at an EBIT of KES.94.9 billion, a 3.5% growth year on year.

The earnings surpassed both the market expectations and the group guidance range of KES129billion-132billion.

This performance was driven by customer segmentation, public sector digitisation, investments in new technologies and better use of data and analytics to understand and serve customers better.

Peter Ndegwa, Safaricom PLC CEO said: “We are extremely pleased with what we have been able to achieve as a group despite the significant startup costs in our Ethiopia business.

We expect that from 2025, Ethiopia will start being a significant growth contributor at group level for both top and bottom line.”

In the period under review, Safaricom PLC Group revenue grew by 13.4% to KShs 335.3 billion, with M-PESA contributing 42.4% of revenue at KShs at 140 billion and GSM business contributing 52.7% at Kes.173.9 Billion.

In the period under review, Safaricom PLC Group revenue grew by 13.4% to KShs 335.3 billion, with M-PESA contributing 42.4% of revenue at KShs at 140 billion and GSM business contributing 52.7% at Kes.173.9 Billion.

Mr Ndegwa spoke during the announcement of the Full Year 2023/2024 results, which saw net income increase by 13.7% to KShs 84.74 billion for Safaricom Kenya.

While the Group net income excluding minority interest increased by 1.2% to KShs 62.99.

Mr. Ndegwa noted that the company vision towards purpose-led technology company was a key factor in investment in new technologies that have enabled in creating more efficiencies and better customer engagement.

“We are able to anticipate and serve our customers more intuitively, while engaging our communities to solve their societal challenges.

As a result of our razor-sharp focus on our customers, we are now a billion-dollar business in Kenya.” Mr. Ndegwa noted.

On Ethiopia, Safaricom CEO noted, “We have doubled our active customer base to 4.4M, we have built a world class network that is currently almost half the Kenya’s size and are on track to meet our licence obligations.

On Ethiopia, Safaricom CEO noted, “We have doubled our active customer base to 4.4M, we have built a world class network that is currently almost half the Kenya’s size and are on track to meet our licence obligations.

We are hence pleased with commercial momentum in Ethiopia and proud that we have been able to deliver this momentum with a Safaricom Ethiopia team that is 90% Ethiopians.”

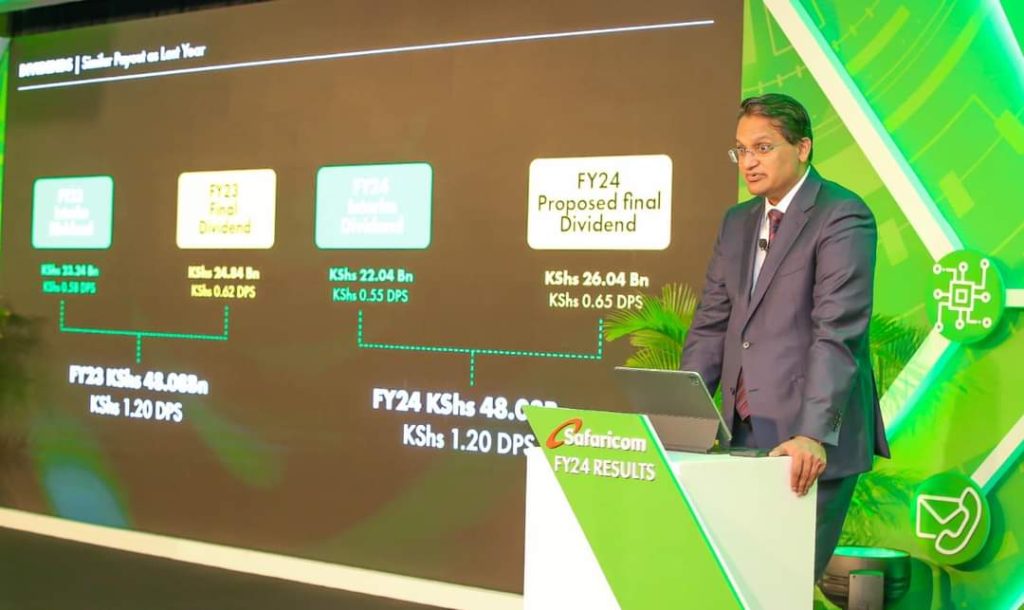

Adil Khawaja, Safaricom Board Chairman, “As a result of this growth, the board will recommend a final dividend of 65 cents per ordinary share bringing the total dividend payable for FY24 to one shilling and twenty cents per share, equivalent to KES.48.08 billion.”

Safaricom has also announced its support towards the floods victims through M-PESA Foundation.

The KShs30 million will be used to support the initial relief efforts that include vital supplies, food, temporary shelter, medicines, and emergency medical kits in affected areas.

Mr. Khawanja noted that the company would continue to pursue its Purpose of Transforming Lives and engage more with the communities they served.

Mr. Khawanja noted that the company would continue to pursue its Purpose of Transforming Lives and engage more with the communities they served.

Key Highlights FY – Safaricom Group (including Ethiopia)

Service Revenue 5.2% to KES 295.7 Bn.

Voice revenue -2.6% to KES 81.1 Bn

M-PESA revenue 8.8% to KES 117.2 Bn.

Mobile data revenue +11.4% to KES 54.0 Bn.

Total customer base 8.1% to 45.9Mn.

One-month active M-PESA customers 5.2% to 32.1Mn.

One-month active mobile data customers 7.0% to 26.1Mn

Net Income:

Safaricom Group excluding Minority Interest -10.6% to KES 62.3 Bn

Safaricom Plc Kenya, +3.0% to KES 74.5Bn

Safaricom PLC Operating Free Cash Flow +4.3% to KES 115.7 Bn.