- Traditional Digital vs. AI-Enabled Insurance: Is it Time to Go Fully AI?

In an era of rapid technological advancement, the insurance industry stands at a crossroads between tradition and innovation.

For decades, insurance operations have relied heavily on traditional non intuitive digital systems—from claims processing to policy administration.

But with the rise of artificial intelligence (AI), the industry now faces a critical question:Is it time to eliminate paper entirely?

To illustrate AI’s growing impact, recent research by Binariks indicates that the global AI in insurance market was valued at $4.59 billion in 2022 and is projected to reach approximately $79.86 billion by 2032, growing at a compound annual growth rate (CAGR) of 33.06% from 2023 to 2032.

The Benefits of AI in Insurance on a Digitally Enabled, Paperless Ecosystem:

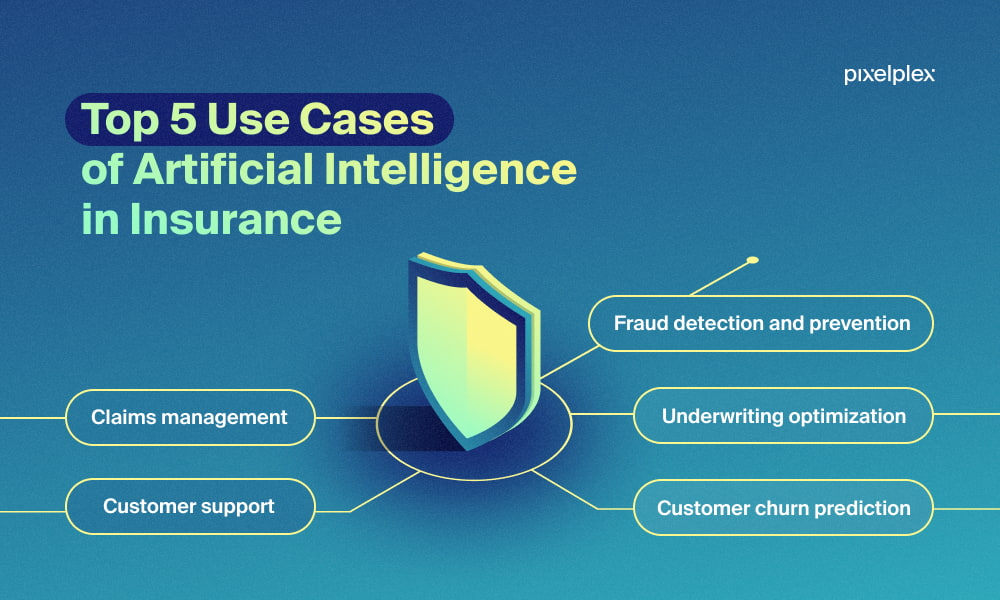

AI is revolutionizing the insurance landscape in several ways, automating processes previously bogged down by manual input tasks. From customer onboarding, underwriting to claims management, AI can further automate operations, shorten processes, reduce human error, shorten steps and enhance the customer experience. Key benefits include:

- Speed and Efficiency:AI can analyze vast amounts of data quickly and shorten steps, speeding up underwriting and claims processing while improving accuracy.

- Cost Savings:Automating routine tasks with AI reduces administrative costs, enabling insurance companies to focus on strategic initiatives and potentially lower premiums for customers.

- Personalization:AI can analyze customer data and preferences to offer personalized policy recommendations, resulting in more tailored insurance plans and higher customer satisfaction.

- Fraud Detection:AI systems can detect patterns of fraudulent activity more efficiently than traditional methods, helping minimize risks and losses.

Smart’s Implementation of AI Driven Claims Adjudication:

Being the pioneers in automating medical scheme management using biometric technology, we have built a fully paperless ecosystem that supports this critical component in the insurance industry.

Whilst, we agree that digitization takes the lead, there exist significant effort processes which have hampered 100% value derivation from end to end digital ecosystems.

With the incorporation of AI & machine learning in our Smart solutions, we are harnessing AI’s transformative power to achieve this desired 100% value derivation in our e-claims ecosystem that seamlessly digitizes the claims interconnection between members, healthcare providers and payers.

Our Smart AI Straight-Through Processing (STP) for claims adjudication, leverages AI to automate the entire claims process—from submission to settlement—eliminating manual intervention.

This innovation speeds up claim resolution, reduces errors through continuous learning, and enhances customer satisfaction by ensuring swift settlement and reducing the human adjudication resource burden.

By integrating AI through STP, Smart has transformed the traditionally paper-heavy claims process into a seamless digital workflow, cutting administrative costs and demonstrating the real-world impact of AI in insurance.

The Role of Traditional Digital Systems in Insurance:

The Role of Traditional Digital Systems in Insurance:

Despite the benefits of AI, traditional digital insurance systems still hold significance in the insurance industry. Segments of insurers prefer scanned physical documentation with signatures, and paper serves as a reliable backup in case of technological failure.

Some argue that retaining paper records can enhance security, especially in regions with limited digital infrastructure or where legal disputes are a concern, for which evidence in form of a paper record is acceptably seen as more robust.

Challenges of Going Fully Digital:

While AI offers undeniable benefits, going entirely paperless comes with challenges:

- Data Security Concerns:AI systems require advanced cybersecurity measures. A breach could expose sensitive customer information, making some insurers hesitant to fully transition from paper.

- Regulatory Compliance:Many regulators and instilled best practice in some segments of industry have ingrained physical documentation for conformity purposes, forcing insurers to balance AI adoption with compliance requirements.

- Digital Divide:Not all customers have access to digital platforms, particularly in developing regions. A fully digital approach may alienate certain customer segments who rely on traditional methods.

Is a Hybrid Approach the Answer?

Is a Hybrid Approach the Answer?

For many insurers, a hybrid approach—combining AI’s efficiency with traditional digital systems and paper’s reliability—may be the most practical solution. AI can manage routine tasks like claims processing, standard customer queries and customer support, while paper is retained as a backup during system failures.

While AI promises to streamline insurance processes, eliminating paper may not be the best approach—at least not yet. A balanced, hybrid model allows insurers to cater to diverse customer needs while ensuring security and compliance. As AI evolves and digital adoption accelerates, the question will shift from whether to eliminate paper to how to make the transition to a fully digital AI driven ecosystem as seamless as possible.

Our implementation of Smart AI claims adjudication STP exemplifies how digital innovation is reshaping the insurance industry. By embracing AI, insurers are setting new standards for efficiency and customer service, paving the way for a paperless, fully automated future.

Our implementation of Smart AI claims adjudication STP exemplifies how digital innovation is reshaping the insurance industry. By embracing AI, insurers are setting new standards for efficiency and customer service, paving the way for a paperless, fully automated future.

For more of this engagement, join us at the upcoming 4th Smart Summit, at Kampala Uganda, 31st of October. Let’s drive digitization for sustainable economies and societies.

- The Author is the Group Managing Director, Smart Applications International Ltd