NCBA Group PLC has posted a profit before tax of KES 15.03 billion for the financial year ending December 31, 2021.

The Group registered a full year profit after tax of KES 10.22 billion representing 124% growth up from KES 4.57 billion reported in 2020. Growth in profitability was attributed to an increase in operating income of KES 2.7 billion and a significant decline in loan impairment charges of KES 7.7 billion.

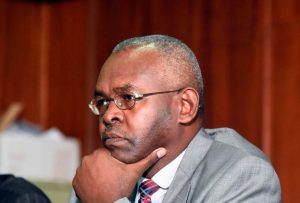

John Gachora, Group Managing Director, NCBA Group said, “I am extremely proud of the financial results that the Group delivered in 2021. While there is still much more to do, it is clear that our merger is paying dividends. The results are a reflection that we are delivering on our strategy despite the headwinds introduced by COVID-19.”

“We now have a strong balance sheet with total assets up KES 63.1 billion to close at KES 591.1 billion and customer deposits up by KES 48.4 billion to close at KES 469.9 billion. We remain well capitalized with core capital at KES 70.9 billion and have a robust liquidity of 61.7%. This foundation has allowed us to continue serving our customers effectively through-out the pandemic.” John Gachora added.

Key Summary Highlights

- Asset base rose to KES 591.1 billion, 12% up year on year

- Customer deposits closed at KES 469.9 billion, 11% up year on year

- The Group disbursed KES 584 billion in digital loans, 35% increase year on year in line with its digitization agenda

- Operating income of KES 49.2 billion, 6% up year on year

- Cost to income ratio of 42.18%, flat year on year

- Operating profit before loan loss provisions of KES 28.4 billion, 6% up year on year

- Loan impairments charges for the period at KES 12.7 billion, 38% down year on year

- Non-Performing loans coverage ratio increased to 73.6%, from 60.9% in the same period last year

- Profit before tax of KES 15.03 billion, 202% up year on year

- Profit after tax of KES 10.2 billion, 124% up year on year

Proposed Dividend

For the year 2021, the Board has resolved to recommend to the shareholders for their approval at the Annual General Meeting scheduled for 4th May 2022, the payment of a final dividend for the year of KES 2.25 per share which together with the interim dividend paid of KES 0.75 per share brings the total dividend for the year 2021 to KES 3 per share. The dividend will be payable to the shareholders registered on the Company’s register at the close of business on 13th April 2022 (closing date for determination of entitlement to dividend).

A Strategy That Delivers

In this strategic cycle, the Group has committed to investing in initiatives that build a Distinguished Brand Known for Customer Experience, Scale Retail Banking, Deepen its Market Leadership in Corporate Banking & Asset Finance, enable Digital Transformation and Develop a High-Performance Culture.

In 2021, NCBA had the fastest growing branch network in the country.During the year, the bank in Kenya opened 13 new branches across Mombasa, Nyeri, Karatina, Ruiru, Bungoma, Embu, Kakamega, Kericho, Ngong, Naivasha and Kiambu. This contributed to growth in the deposit base for the bank resulting in 11% growth of the Group’s deposits. In 2022, NCBA will launch 12 additional branches tocontinue bringing its services closer to its customers.

During the year,NCBA finalized the post-merger consolidation of its mobile banking channels under the NCBA Now mobile app.This exercise was intended to deliver merger cost synergies and to provide a unified platform from which to elevate customer experiences. All NCBA customers now have the ability to pay directly to M- Pesa tills, the ability to borrow up to KES 70,000 in unsecured digital loans and the ability to make FX trades digitally. The new and improved app has also incorporated biometric log-in to further secure customer transactions.

The Group was proud to have been awarded the 2021 KBA 3rd Place Customer Experience –Tier 1 Banks Award. This award is a reflection that the concerted efforts across the Group to deliver more seamless and delightful experiences are bearing fruit.

Citizenship

In line with its promise to Inspire Greatness,NCBA invested throughout the year in initiatives that supported the protection of the environment and furthered education.

Under the environmental campaign dubbed #”ChangeTheStory”,NCBA invested KES 4.3 million towards reforestation efforts, planting 46,000 trees around the country. This was part of its commitment to support a national target of 10% tree cover by 2022.

Under education, NCBA invested KES 8 million towards educational sponsorship with a goal of ensuing that no child misses out on the opportunity for greatness. The Group was proud to partner with Palmhouse Foundation, Edumed Trust, Mpesa Foundation, Dr. Choksey Albinism Foundation and SOS Children’s Villages Kenya to deliver the sponsorship programmes. Incrementally, NCBA also partnered with Junior Achievement Kenya, under its job shadow programme, to educate over 40 students and youth on entrepreneurship, work readiness and financial literacy through experiential programs.

In 2021, the Group launched the inaugural NCBA Golf Series, attracting over 3000 golfers to participate in tournaments across 16 golf clubs countrywide.This year, the Series expands across the Region with 18 tournaments in Kenya, Uganda and Tanzania.

“Our NCBA Golf Series has the objective of growing and supporting the sport not only for adults but also for our juniors. Last year we were very proud that over 40 of our junior golfers qualified to play at the Rome Classic and the Big 5 tournament in South Africa. Their strong show in these world-class events affirmed that we are well on our way to developing the future stars of the sport, not just locally but globally,” Gachora said.

While reflecting on the 2022 outlook, John Gachora added: “NCBA has successfully adjusted to a new normal in this Covid-era. Our business is more resilient than ever before and is on a strong path for growth. I am very excited that our branch expansion and digitization plans are making us more relevant to a wider base of customers and enabling us to serve them better.”