With this investment, MyCredit will continue to improve access to capital for SMEs in a fast, convenient and affordable way. The institution has disbursed 15,500 loans to customers across Kenya with a total value of KES 6.08 billion in the last six years. Over that period, MyCredit has opened 15 branches and created 158 jobs.{Photo/Courtesy}

The loan facility from Oikocredit will support Kenyan financial company MyCredit to offer affordable, medium-term financing to local SMEs

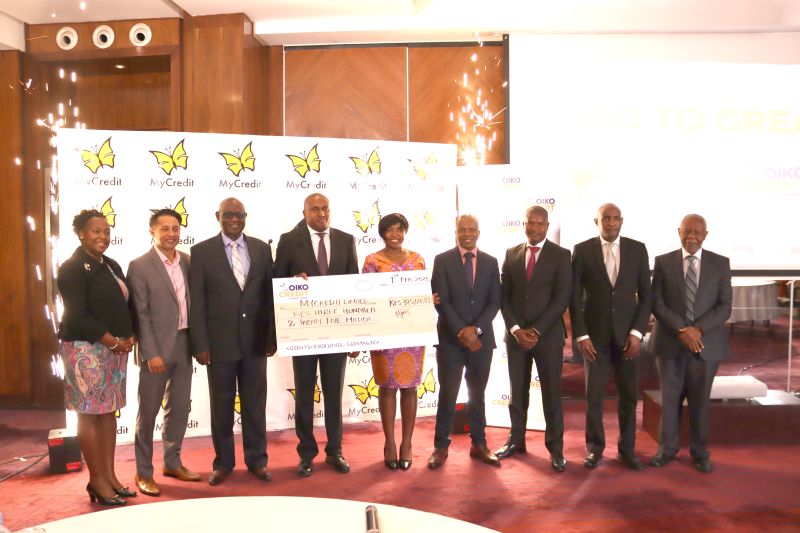

Social impact investor Oikocredit has approved a loan facility of US$ 2.6 million (KES 325 million) to MyCredit Limited. MyCredit is a non-bank financial institution in Nairobi, Kenya with over 10,000 customers. Through this new partnership with Oikocredit, MyCredit will fulfil its mission to support businesses and local communities to achieve greater financial freedom through tailor-made loans to small and medium enterprises (SMEs), professionals and civil servants.

With this investment, MyCredit will continue to improve access to capital for SMEs in a fast, convenient and affordable way. The institution has disbursed 15,500 loans to customers across Kenya with a total value of KES 6.08 billion in the last six years. Over that period, MyCredit has opened 15 branches and created 158 jobs.

This new funding deal contributes to Oikocredit’s mission to provide loans to organisations active in the financial inclusion sector and improve lives for low-income households throughout Kenya.

George Mbira, MyCredit’s CEO said: “The secured funding will support MyCredit’s strategic plan to offer affordable and medium-term financing of up to a maximum of three years to its SME customers who are in trading businesses. Through this partnership, the SMEs will be able to create more job opportunities in the communities within which they operate.At MyCredit, we are excited to build a truly pan-African business in the next 10 years, opening branches in all 47 counties and commercial centres to reach and develop missing middle enterprises.”

Michael Kariah, Oikocredit’s Investment Officer East and Southern Africa said: “This transaction enables Oikocredit and MyCredit to work together to provide funding to support SMEs in Kenya and further extend our social impact. SMEs are one of the main pillars of economic growth as they have a multiplier effect of supporting many households through the creation of sustainable jobs. Our funding and capacity-building support will enable the company to make further progress in key impact areas while expanding the outreach to more underserved SMEs in the country.

2 thoughts on “MyCredit,Oiko signs US$2.6Mn deal to boost and fund SMEs”