Jubilee Health Insurance, in collaboration with DTB (Diamond Trust Bank), has unveiled a revolutionary innovation that will transform how health insurance premiums are paid.

This first-of-its-kind solution in the healthcare industry recognizes that paying insurance premiums upfront once a year can be unaffordable for many Kenyans.

To address this, the solution allows customers to pay in flexible installments—”Lipa Polepole”, offering them the freedom to select the number of payments that suit their budget.

This innovation marks a significant leap in the health insurance landscape, combining cutting-edge digital platforms with customer-centric design to solve one of the industry’s most persistent challenges—affordability.

For years, many households in Kenya, particularly in rural and lower-income areas, have faced financial barriers when accessing healthcare.

For years, many households in Kenya, particularly in rural and lower-income areas, have faced financial barriers when accessing healthcare.

According to the Kenya Demographic and Health Survey (KDHS) 2022, over 20% of Kenyans still lack access to health insurance, and 30% of the population faces catastrophic healthcare costs due to the burden of upfront medical payments.

Now, with this online process, customers can complete their health insurance transactions in just five easy steps using their mobile phones.

Whether purchasing a new health insurance policy or renewing an existing one, customers can apply, select an installment plan, and receive instant approval—ensuring they are covered right away.

“This innovation is a game-changer for the industry,” said Njeri Jomo, CEO of Jubilee Health Insurance. “We understand that today’s customers need flexibility, convenience, and affordability.

Our solution delivers all of these, allowing them to get the coverage they need without the burden of upfront payments.

This milestone reflects our commitment to making healthcare accessible to everyone,regardless of their financial situation.”

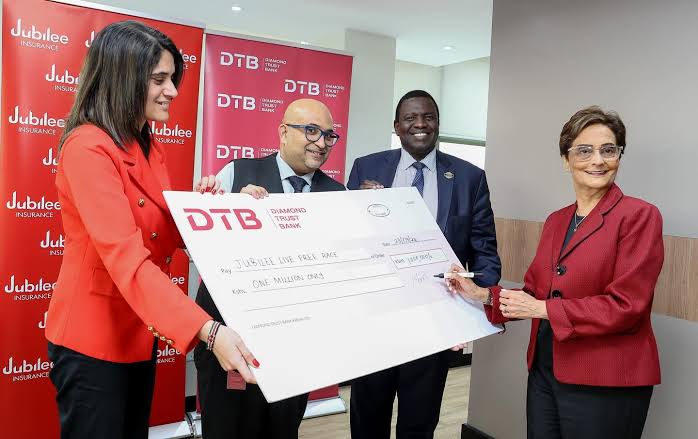

This innovation stems from a strategic collaboration between Jubilee Health Insurance and DTB.

This innovation stems from a strategic collaboration between Jubilee Health Insurance and DTB.

Through this partnership, DTB provides the financial infrastructure needed to ensure that customers can access their health insurance through affordable installment payments, making healthcare more accessible across Kenya.

Nasim Devji, CEO of DTB, said: We are proud to collaborate on this innovative solution that democratizes access to healthcare across Kenya.

By combining our expertise in financial services with Jubilee’s innovative health insurance offering, we are making it easier for individuals and families to access essential healthcare services.

This is a significant step toward achieving financial inclusion and health security for all.”

This is a significant step toward achieving financial inclusion and health security for all.”

This Lipa Polepole solution, designed with the customer in mind leverages technology to provide real-time approval for health insurance coverage. Customers can access their health cover instantly through a secure platform that eliminates the need for paperwork or lengthy approval processes.

The solution caters to individuals, families, and small businesses, offering flexible payment terms that allow premiums to be paid over time.

Jubilee Health’s digital installment option is the first in the market to integrate instant, digital financing options with health insurance, setting a new standard for how health insurance is offered.

This move is anticipated to influence how other industry players approach premium financing, further driving innovation in healthcare access.

“We are proud to lead this charge in transforming healthcare access in Kenya,” Jomo added. “This innovation goes beyond convenience; it’s about breaking down financial barriers to healthcare.

With this solution, no one has to delay or forgo healthcare because of cost.

We are setting a new industry standard.”

With this new digital payment option, customers can now sign up for health coverage online via www.jubileekenya.com, select their desired installment plan, and receive instant approval.

This allows them to remain insured without the pressure of significant upfront payments, providing peace of mind and financial flexibility.

This allows them to remain insured without the pressure of significant upfront payments, providing peace of mind and financial flexibility.

By simplifying health insurance payments, Jubilee Health Insurance is taking a bold step toward digitizing healthcare access and empowering more people across Africa to secure their health.