ICEA LION Asset Management CEO – Einstein Kihanda and Judd Murigi, Head of Research at ICEA LION Asset Management at the launch of ICEA LION Asset Management Reports Stable Consumer Spending Trends.

ICEA LION Asset Management Reports Stable Consumer Spending Trends in Q4 2024

- The Fourth Quarter 2024 ILAM Consumer Spending Index shows a 2% increase in consumer spending, driven by slight improvements in individual spending and retail business sales, defying expected seasonal trends.

East Africa’s pioneering investment management firm, ICEA LION Asset Management,released the Fourth Quarter 2024 ILAM Consumer Spending Index, with the theme ‘Consumer spending trends stable in the final quarter of 2024 despite anticipated seasonal effects’.

The index is aimed at tracking consumer spending as a gauge of the trends in the real economy.

It is based on interviews with approximately 1,200 consumers and over 200 retail businesses in major urban centres across the country.

Speaking at the event, Judd Murigi, Head of Research at ICEA LION Asset Management highlighted the following key trends:

- Static income trends dominate

60% of respondents indicated their income levels ended 2024 at the same level as 2023, while one-quarter of individuals surveyed ended the year with lower incomes compared to the beginning of the year. This represented the highest proportion of flat income levels dominating income trends during the year.

However, we also note that the proportion of individuals reporting lower incomes declined to the lowest levels witnessed during the year.

The real estate and construction sectors had the largest proportion of respondents who had higher incomes compared to 2023 while the wholesale and retail sector had the biggest proportion of workers whose incomes declined during 2024. This represented the second successive quarter when the trade sector has led to declining income trends

- ILAM Consumer Spending Index rises by 2% in Q4 2024

The ILAM Consumer Spending Index rose by 2% in the final quarter of 2024, driven by a slight improvement in both individual spending and retail business sales.

- Retail business sales trends similar to the third quarter of 2024

60% of retailers surveyed reported an increase in sales compared to the final quarter in 2023, while approximately 40% had lower sales in the quarter.

This was similar to trends witnessed between July and September 2024 as the expected uplift from the festive season did not appear to materialise.

In terms of business sectors, the clothing, retail shopping, and food & beverage sectors witnessed higher sales in the final quarter of 2024 compared to the previous year, while the household fittings and accessories sector saw most businesses report lower sales trends between October and December 2024 compared to the prior year

On a quarter-on-quarter basis however, retail stores and food and beverage sector businesses had lower sales trends in the fourth quarter compared to the third quarter, a surprise development in view of the festive season when sales in these sectors are expected to pick up.

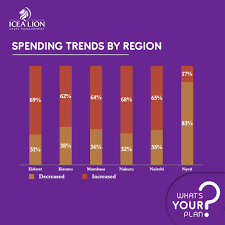

The majority of retail businesses in Nairobi, Mombasa, Eldoret, and Kisumu reported improved sales, but Nyeri bucked the trend with most retailers experiencing lower sales.

- Men spending picks up while women remain flat

Individual spending trends rose marginally by 1% in the final quarter of 2024 compared to the third quarter.

For the second quarter in a row, male spending trends picked up more than female spending trends. The real estate and transport sectors had the biggest proportion of respondents who spent more during the quarter.

In terms of age groups, only the 26 – 35 age group had the highest proportion of individuals spending more, all other age groups reported lower spending trends

In closing, ICEA LION Asset Management CEO – Einstein Kihanda, who is also the immediate former Chairman of the Institute of Certified Investment and Financial Analysts (ICIFA) summarised thus: “Consumer spending trends in the final quarter of the years were broadly similar with those in the third quarter”.