–Gulf African Bank and African Guarantee Fund Sign 1st Shari’ah Compliant Credit Risk Guarantee Scheme in Sub-Saharan Africa.

– This is the first Shari’ah compliant credit risk guarantee in sub-Saharan Africa

– The Bank will scale up its financing to women owned enterprises and sustainable or green businesses.

– The partnership is going to enable the Bank to expand its activities and improve its product offering to the SMEs and MSME sectors in Kenya.

– The partnership will also cover capacity development assistance to increase the Bank’s capacity to appraise

SMEs and implement growth strategies to bring the Bank’s SMEs to their required scale.

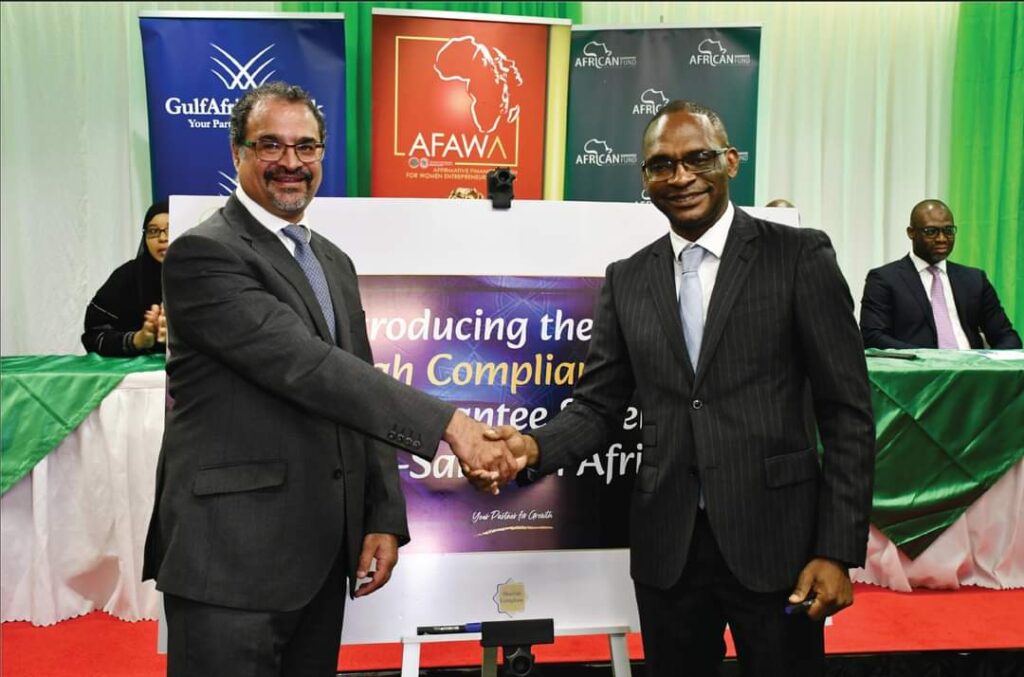

Leading Shari’ah compliant financier Gulf African Bank has signed a Shari’ah compliant credit risk guarantee partnership with African Guarantee Fund (AGF) to enable the Bank’s SMEs access financing to support their growth.

This is the first Shari’ah compliant credit risk guarantee in sub-Saharan Africa, which marks a critical milestone for both institutions.

This is the first Shari’ah compliant credit risk guarantee in sub-Saharan Africa, which marks a critical milestone for both institutions.

Through the partnership, the Credit Risk Guarantee Collateral Cover will enable access to financing facilities by SMEs that qualify on all fronts but lack suitable or adequate collateral.

This will lead to the provision of acceptable collateral to cover the unsecured portions the facility while enabling the Bank to effectively and efficiently achieve a desired SME quality asset book and reduce credit losses.

Speaking during the partnership signing ceremony, Gulf African Bank’s MD Anuj Mediratta said,

“We are proud to have partnered with AGF to roll out the first Shari’ah compliant Credit Risk Guarantee scheme in sub-Saharan Africa, a de-risking arrangement that will enable SME’s that could not access financing facilities due to inadequate collateral and absence of Shari’ah compliant collateralization arrangements a chance to access credit from the Bank.

Through this partnership, we are going to finance more SMEs thereby allowing them to play their role in driving Kenya’s economic growth.

We also share a mutual goal of expanding the SME space in Kenya, to ensure that more employment opportunities are created and livelihoods are positively impacted”.

The facility availed through this partnership will support the Bank to scale up its financing to women owned enterprises and sustainable or green businesses that are involved in the renewable energy produce eco-friendly products and services or offer green service.

Through this partnership,the Bank aims at maximizing opportunities through climate action and support the attainment of SDG 17,which aims at strengthening the means of implementation and revitalizing the Global Partnership for Sustainable Development enterprise growth in Kenya by enabling access to quality and affordable credit for SMEs that qualify for credit facilities sought, but lack adequate collateral.

AGF will additionally provide capacity development assistance to increase the Bank’s capacity to appraise SMEs and implement growth strategies to bring the Bank’s SMEs to their required scale.”

The agreement is supported by the African Development Bank’s Affirmative Finance Action for Women in Africa (AFAWA) and will significantly increase financing of women SME.Commenting on the partnership, African Guarantee Fund Group CEO Jules Ngankam said “AGF has entered into a first of its kind guarantee partnership to support Gulf African Bank’s SME financing strategy in line with the approved Shari’ah principles.

Our partnership will promote enterprise growth in Kenya by enabling access to quality and affordable credit for SMEs that qualify for credit facilities sought, but lack adequate collateral.

AGF will additionally provide capacity development assistance to increase the Bank’s capacity to appraise SMEs and implement growth strategies to bring the Bank’s SMEs to their required scale.”

The agreement is supported by the African Development Bank’s Affirmative Finance Action for Women in Africa (AFAWA) and will significantly increase financing of women SMEs.