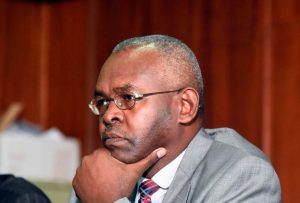

Family Bank Customer Experience Manager Maureen Ndegwa, Chief Operations Officer John Ndugi, Head of Customer Experience Joyce Mwangi & Contact Centre Assistant Manager Penina Mbugua receive the best tier two bank and overall third best bank in customer satisfaction & digital banking experience in the KBA Customer Satisfaction Survey 2023.

- Family Bank bags Best Tier2 in KBA’s Customer Satisfaction Survey 2023

Family Bank has been voted as the best tier two bank and overall third-best bank in customer satisfaction and digital banking experience in a 2023 survey conducted by the Kenya Bankers Association.

The 2023 survey obtained over 30,000 responses countrywide.Family Bank has maintained the position as the best tier two bank for the fourth year running and has been voted among the overall best bank in customer satisfaction and digital experience.

“Digital transformation continues to be our key focus as a Bank. This is to create convenience for our customers by providing them with personalized products that meet their changing needs,” said Family Bank Chief Operations Officer John Ndugi.

“This recognition is a testament that our customer centric culture continues to have a positive impact on our customers in the provision of our services and products.

We continue to be committed to making sure that we meet the evolving needs of our customers,” he added.

According to the survey,channels leveraging on technology emerged to be the most preferred banking channels with mobile banking emerging top with 70% and online/internet banking at 24.6%.

The survey further noted that bank customers preference for fully automated or self-service modes including mobile,internet and chatbots when accessing banking services continues to be a key area of interest with 45% of respondents preferring this mode of interaction while an increase to 16.5 % of the respondents preferring human-assisted service including call centers and branches.

The growing preference of digital banking was a key focus of the survey with 94.6% of respondents indicating their preference for digital services. Physical services according to the survey is still an integral part of the banking experience with respondents still preferring a physical experience for some services.

Numerous respondents, according to the survey, highlighted a preference for multi-banking with 62% identifying as having more than one bank, which is a 5% increase from last year’s survey.Respondents pointed out the need to access a variety of high-quality services as the main reason for having multiple banking relationships.