The banking industry in Kenya has undergone a significant digital transformation in recent years, with the sector embracing technology to meet the growing demand for convenient, accessible, and affordable banking services. Equity Group has been at the forefront of this transformation, with a suite of digital products that have positioned the bank as a market leader, not just in Kenya.

According to McKinsey’s December 2022 report on the state of African banking, digital adoption in Africa is between 20% and 30%, which is significantly lower than other global markets. In Latin America and Asia, for example, digital adoption is around 50%, while in other global markets, it is as high as 72%. However, Equity Bank’s digital products have been way ahead of the industry standards in Kenya, providing customers with a range of options for accessing financial services.

Commenting on the banks business transformation agenda while releasing the lender’s 2022 Full Year Results, Equity Group CEO, Dr James Mwangi, Said “The COVID-19 environment acted as a tailwind for business transformation through innovation and digital adoption. 97% of all Group transactions are on customer self-service on own devices driving efficiency gains, ease and convenience to customers and reduction of fixed and variable costs. The Group’s latest breakthrough is digital e-Commerce payments through Pay with Equity (PWE) rails following the wave of mobile and internet banking usage by customers.”

According to data from Equity’s 2022 Full Year Results Investor Briefing Booklet, 97% of the group’s transaction now happen outside physical branches and ATM network. During the year under review, 1.28 trillion transactions were completed on Equity Mobile, Equity Online, Agency Banking and Merchant outlets.

When it comes to transaction values, 73% of Equity’s transaction values is also happening on digital platforms. This is way ahead of the Kenyan market where a recent report by the Kenya Bankers Association(KBA)puts customers who prefer automated banking channels at 67% but with demand expected to grow with the industry investing in innovative and smore secure digital products.Pay With Equity (PWE) is one of Equity Bank’s digital channels that has experienced tremendous growth in recent years. The platform’s transactions grew by 393% to 131.5 million transactions, while the volume of business transacted grew by 281% to Kes 524B in 2022. PWE’s popularity is driven by interoperability, which allows customers to use various mobile wallet operators, including M-Pesa, Airtel Money,Pesalink, Equitel, Equity Online, or Equity Mobile. Merchants are not charged any commissions, and transactions are settled in real-time, providing convenience to both customers and merchants.

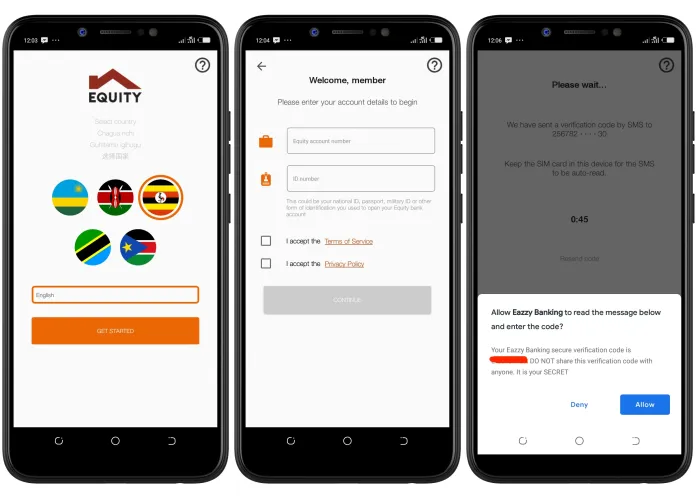

Equity’s revamped internet banking platform that’s now known as Equity Online (formerly EazzyNet) also saw transaction volumes grow by 212% to 10.7 million transactions in 2022, and the value of the transactions has grown by 136% to Kes 311B in 2022. The bank’s mobile banking app,Equity Mobile (formerly EazzyBanking), has also grown in popularity, with customers using it to access a range of financial services, including sending and receiving money, paying bills, and accessing loans.The Kenya Bankers’ Association survey mentioned earlier also indicates that the preference for interacting with a bank representative when raising a complaint or seeking customer support remains high. Equity Bank has taken note of this, as the bank’s digital transformation has not only focused on providing convenience to customers but has also enabled the bank to reduce its fixed costs by transitioning to third-party variable cost channels and self-service platforms. The bank’s physical branches now handle high-value transactions for SMEs and corporates, wealth management, and advisory services. The digital channels have enabled the bank to provide accessible, affordable, and reliable financial services to customers, even in remote areas.

Equity Bank’s focus on innovation and digitization has enabled it to stay ahead of the curve and meet the ever-changing needs of its customers. With a growing demand for digital banking services,Equity Bank’s digital products are well-positioned to meet the needs of its customers and maintain its position as a leader in the banking industry’s digital transformation journey. The bank’s digital products are not only ahead of the industry standards in Kenya, but they also surpass the digital adoption rates in other African markets, according to McKinsey’s report.

In conclusion,Equity Bank’s digital transformation journey has been nothing short of remarkable, with the bank introducing a range of digital products that have transformed how customers access financial services. With the bank’s digital products being well ahead of the industry standards in Kenya and surpassing digital adoption rates in other African markets, Equity Bank is undoubtedly a market leader in the banking industry’s digital transformation journey. The bank’s commitment to innovation and digitization has enabled it to remain relevant and stay ahead of its competitors.

2 thoughts on “Equity Group:Leading the Digital Transformation of Kenya’s Banking Industry”