- Value of the transactions growing by 66% to reach KESs2.5 trillion up from KES 1.2 trillion.

- The shift in consumer behaviour accelerated by the Covid-19 pandemic accredited for the rise in digital transactions.

The uptake of digital banking services by customers is moving Equity Group Holdings Plc away from the brick and mortar fixed-cost business model to a variable-cost third party based infrastructure business model.

In the just-released 2021half-year results, digital channels accounted for 97% of the group’s transactions. 606.9 million transactions were complete through the Eazzy banking suite, agency banking and merchants compared to 385.2 million recorded last year, indicating a 66% growth.

In terms of value, transactions worth KES 2.5 trillion were made on the digital channels compared to KES 1.2 trillion last year.

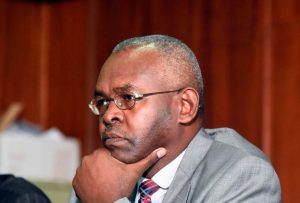

Commenting on the growth during Monday’s investor briefing, Equity Group CEO Dr James Mwangi said “this growth shows the success of the Group’s strategy of migrating the customers from the legacy banking infrastructure to the digital banking infrastructure. This speaks to the appropriateness of the offering to the customer. We have pushed control, freedom and choice to the customer.”

“Banking has become a 24-hour activity, the control of the account is also by the customer and this gives them freedom and convenience,” he added.

The Covid-19 pandemic has accelerated the adoption of digital banking and payment solutions by forcing consumers to shift behaviours and adopt more technology to assist with their day-to-day lives in all aspects, including their finances.

“Covid-19 pandemic has acted as a tailwind for customers’ adoption of digital offering fastening the pace of business transformation with significant upside on efficiency as the Group increasingly becomes a technology platform and transform from being a fixed cost business to a variable cost business,” said Dr Mwangi.

Transactions on Equity Bank’s EazzyApp grew by 95% from 200.4 million transactions in 2020 to 390.3 million. In terms of value, there was a 186% growth from KES 97.1 billion to KES 277.6 billion. Agency banking transactions grew from 37.6 million to 39.5 million while merchant transactions grew from 9.7 million to 11 million, indicating a growth of 5% and 13% respectively.

The bank’s other digital channels like Equitel, EazzyFX (forex trading), EazzyBiz and EazzyPay also recorded significant growth in the first half of the year.

During the period under review, transactions on the group’s fixed cost brick and mortar branch and ATM infrastructure grew to KES 1.4 trillion from KES 1.1 trillion.

Equity Group has invested in building and onboarding platforms that allow it to respond to customer demands and stay steps ahead of the market in delivering efficient and convenient experiences to the consumer.