- [Empowering Women Entrepreneurs and Small and Medium Enterprises (SMEs) in Nigeria: African Guarantee Fund and Bank of Industry Sign USD 50 Million Guarantee Framework Agreement

- The transaction will be phased out in three tranches over a 10-year period and will significantly scale up BOI’s lending to Small and Medium Enterprises (SMEs) in Nigeria

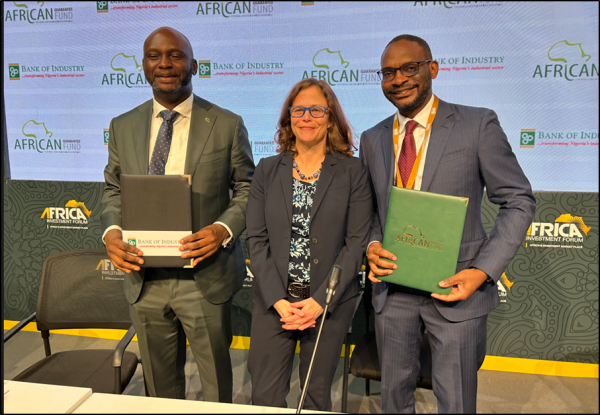

African Guarantee Fund (AGF) and Nigeria’s Bank of Industry (BOI) have signed a USD 50 Million Loan Portfolio Guarantee framework in a bid to propel Nigeria’s industrial sector by providing financial and business support services to enterprises.

The agreement that was signed at the Africa Investment Forum in Rabat is backed by African Development Bank’s Affirmative Finance Action for Women in Africa (AFAWA) initiative.

The transaction will be phased out in three tranches over a 10-year period and will significantly scale up BOI’s lending to Small and Medium Enterprises (SMEs) in Nigeria.

The transaction will be phased out in three tranches over a 10-year period and will significantly scale up BOI’s lending to Small and Medium Enterprises (SMEs) in Nigeria.

The partnership includes a comprehensive risk sharing mechanism that focuses on supporting MSMEs, Women-Owned enterprises and Green businesses to promote environmental sustainability and gender equity.

Speaking during the signing ceremony, AGF Group Chief Executive Officer, Mr. Jules Ngankam said “This transaction with the leading Development Finance Institution in Nigeria is a great milestone that will significantly impact Nigeria’s economy by unlocking up to USD 100 million in financing for SMEs.

Speaking during the signing ceremony, AGF Group Chief Executive Officer, Mr. Jules Ngankam said “This transaction with the leading Development Finance Institution in Nigeria is a great milestone that will significantly impact Nigeria’s economy by unlocking up to USD 100 million in financing for SMEs.

AGF will also provide tailored guarantees and technical assistance towards the special SME products offered by BOI, targeting Women, Youth and Green Businesses.”

The MD/CEO of the Bank of Industry, Dr. Olasupo Olusi, said, “BOI is excited to leverage the guarantee framework of the African Guarantee Fund in promoting sustainable growth, gender equity, innovation and advancing more credit to SMEs in Nigeria in line with President Bola Tinubu’s government’s Renewed Hope agenda”.