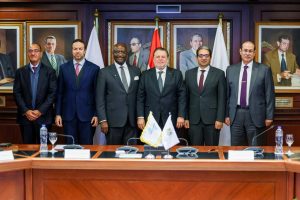

- I&M Group PLC Delivers 35% Growth in Profit Before Tax.

I&M Group PLC has increased its Profit Before tax by 35% to KES 3.6 billion in Q1 of 2024, up from KES 2.7 billion in the same period in 2023.

The Tier 1 Bank reported strong operating revenues across all its markets, with regional businesses accounting for 24% of the Profit Before Tax.

Operating income was driven by significant growth in the corporate and retail segments, which saw increases of 58% and 33% respectively.

- Key Financial Performance Highlights

Balance sheet highlights

▪ The Group’s balance sheet grew steadily, with total assets increasing by 13% over the same period in 2023 to close at KES 533 billion.

▪ The loan portfolio grew by 13% to reach KES 291 billion partly attributable to retail lending and growth in the subsidiary balance sheets.

▪ Customer deposits closed at KES 384 billion, an 18% increase year on year, with both Current & Savings Accounts (CASA) and term deposits growing strongly during the period as the Group continued focusing on product innovation and digitisation.

▪ The Net Non-Performing Loans stood at KES 14 billion, a reflection of the challenging macro-economic environment.

Income statement highlights

▪ Operating income recorded a growth of 21% while the Group’s operating profitability increased by 24% year on year to KES 6.4 billion. Loan loss provisions closed at KES 1.5 billion down from KES 1.6 billion in the same period last year as the Group maintained prudence in asset quality management.

▪ Growth in total operating income was driven by a 38% increase in Net Interest Income for the period under review.

▪ The Group’s operating expenses, exclusive of loan loss provisions recorded an increase of 16% year on year to close at KES 5.1 billion driven by continued investment in technology and people across all markets.

I&M Uganda posted strong growth in operating income of 11% and an operating profit growth of 26%. Total assets reported a 11% year on year growth to close at KES 34 billion, with growth in the loan and deposit book at 27% and 12% respectively.

▪ The Group’s Joint Venture investment in Mauritius, Bank One, recorded a growth of 25% in operating income year on year, driven by the improvement in the balance sheet with total assets growing by 13%.