Joseph Kamiri- General Manager – Marketing and Customer Experience – CIC Group

SME Business Cycle Stages that call for Insurance

By Joseph Kamiri:

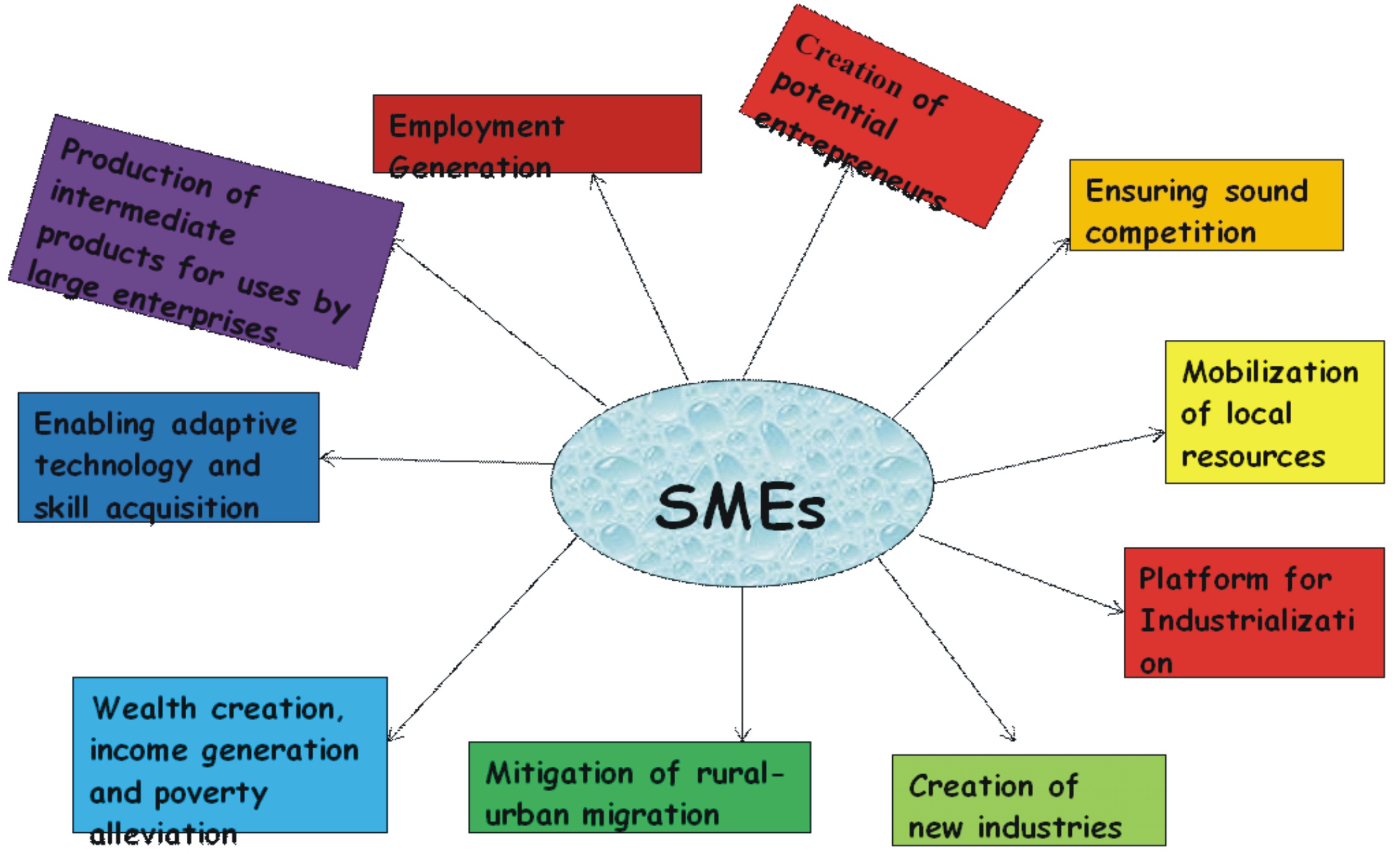

In Kenya, Small and Medium Enterprises (SMEs) employ up to 80 percent of Kenya’s population and make up for 90% of the existing businesses.

As major contributors to the economy, SMEs play a significant role in supporting the livelihoods of millions of Kenyans. Different stages in the business cycle expose SME’s to certain risks, which makes insurance an important tool in ensuring their financial strength and stability.

Inception stage

As a new SME, you definitely have substantial needs and focus areas. Key among them is building strong market influence and registering growth.

Normally, at this stage you may perceive the business as having minimal risk and may not prioritize insurance as a core business need.

At this stage, while your level of risk may be low, a sudden loss or incident leading to damages could register a substantial blow to your business, completely diminishing your current growth and slowing down your progress.

It is therefore prudent, to take up insurance at this stage, to cushion the business against any major risks.

Contrary to belief, insurance is affordable, given that products are tailored to the needs of an SME owner.Expanding into a new territory or market segment.

Entry into a new market exposes the business to a new operating landscape, which also changes the company’s risk profile.

With this in mind, SMEs venturing into new markets, be it locally or regionally, need to take up insurance products that are aligned to any unforeseen market risks or challenges. This is best done by conducting due diligence on the market landscape and adjusting insurance premiums to reflect any risk level changes in the business.

Changing market dynamics;

Some industries are constantly shifting, calling for changes in operations or systems.

The technology and manufacturing industries for instance, are constantly introducing new systems or regulations.

This exposes SMEs to higher risks and calls for a sustained adoption of relevant insurance products.

For instance, an SME that produces goods might have to introduce new machinery into the plant.

During this transition, employees may be exposed to injuries in case of machine failure during processing.

Such risks, without insurance, expose the business to financial losses which can be detrimental to business sustenance.

In this case, while the SME might have only taken up liability insurance to cover claims from injury and damage to visitors and other people or property, it would also have to consider additional insurance products for the buildings, stock and machinery among other assets.

The business will also need to have a compensation plan for its employees for any accidental death, injury or occupational related illness that arises while employees are on duty.

This benefit plan can be achieved by acquiring the Work Injury Benefit Act (WIBA) insurance policy.

Cases of stock loss and damage caused by fire, burglary and floods for instance, are common amongst small and medium enterprises.

Vehicles owned by the business, alongside goods being transported and the drivers driving these vehicles, all require a good insurance cover.

A well-packaged and comprehensive motor commercial insurance cover will insure the vehicle and other people against injury, and damage to their property, following a road accident.

Further, it will also cover for medical treatment of the driver or any other person hurt in an accident caused by the insured’s vehicle, within certain limits.

When it comes to money matters, money stored in a safe within the business premise or in transit, or handled by authorized staff in the business will also require protection.

There are risks that may arise during the daily operations, example theft.

Insuring against such risks will sustain the running and stability of the business.

Where the business requires financing and solely depends on the well-being of the owner, it is important to have measures that will guarantee continuity.

This is where Keyman insurance offers a solution by ensuring that in the demise of the business owner, the financial institution is able to recover the outstanding loan amount.

Keyman insurance allows the family to continue running the business and fulfill the dream of the founder through the proceeds received.

CIC offers all these insurance options and continues to innovate solutions in collaboration with business owners. This is key in ensuring that SMEs find insurance solutions matching their needs.

Increased workforce;

As an enterprise experiences growth, it is highly likely that the number of employees will increase.

This means that SMEs have more responsibility towards employee safety and wellbeing, both of which are amplified by insurance. For instance, the more employees an SME has, the more exposed it is to productivity or financial loss due to sickness or bereavement.

To counter this, SMEs need to take up medical insurance policies that reduce their exposure.

Another consideration would be having a funeral expense cover for employees, to cover costs associated with the loss of a loved one.

Applying such measures will make employees feel valued and is likely to help increase productivity.

Conclusion;

While getting access to affordable insurance in the past was difficult, today’s insurers have developed solutions, platforms and processes that make it easy for small and medium sized businesses to protect themselves from financial risk.

The pandemic further accelerated this, and there are now a number of insurance providers offering affordable, accessible and personalized insurance solutions.

For instance, insurance companies have leveraged on technology to make insurance products more accessible.

This means that as an SME you do not have to deal with long queues or conversations.

You can quickly learn more about an insurance solution online, obtain a quote and sign up for a specific solution within minutes.

With the access and affordability barrier removed, SMEs are now better placed to protect their businesses and support their growth.

SMEs can best do this by leveraging on credible insurance companies that have vast experience and a range of customized solutions.

This can be done through market research to identify an insurer able to meet the changing needs in an efficient, affordable and customizable manner.

CIC Insurance has been operating for more than 50 years as a credible insurance provider.

With customized insurance solutions for businesses such as SME Mediplan, Professional Indemnity, WIBA, Property and Motor Commercial insurance among others, CIC leverages on technology and consumer insights to provide relevant solutions for SMEs, to help mitigate risks in different stages of the business cycle.

The writer is the GM Marketing & Customer Experience – CIC Group