The CBK foreign exchange reserves, which currently stand at USD 6,495 million (3.61 months of import cover), continue to provide adequate cover and a buffer against any short- term shocks in the foreign exchange market.

The Monetary Policy Committee (MPC) met on May 29, 2023, against a backdrop of continued global uncertainties, a weak global growth outlook, easing inflationary pressures, geopolitical tensions, and measures taken by authorities around the world in response to these

developments. The MPC reviewed the outcomes of its previous decisions and measures implemented to mitigate the adverse economic impact and financial disruptions.

• Overall inflation declined to 7.9 percent in April 2023 from 9.2 percent in March, mainly driven by lower food prices. Food inflation declined to 10.1 percent in April from 13.4 percent in March, due to lower prices of vegetables attributed to the ongoing rains, and improved supply of select non-vegetable food items. Fuel inflation remained elevated at 13.2 percent in April, largely reflecting increases in electricity prices due to higher tariffs, and the scaling down of the fuel subsidy.Food inflation is expected to moderate in the coming months following the long rains, and lower global food prices. Nevertheless, the recent increases in electricity prices, the removal of the fuel subsidy, and a sharp rise in sugar prices are expected to exert moderate upward pressure on overall inflation.

• The global economic outlook remains uncertain, reflecting continued concerns about financial sector stability in the advanced economies, continuing geopolitical tensions particularly the ongoing war in Ukraine, and the pace of monetary policy tightening in the advanced economies. However, commodity prices in the global markets, particularly of oil and food, have continued to ease.

• The global economic outlook remains uncertain, reflecting continued concerns about financial sector stability in the advanced economies, continuing geopolitical tensions particularly the ongoing war in Ukraine, and the pace of monetary policy tightening in the advanced economies. However, commodity prices in the global markets, particularly of oil and food, have continued to ease.

• The recently released Economic Survey 2023 shows that the Kenyan economy remained resilient in 2022, despite the subdued agriculture performance due to unfavourable weather conditions during the period. Real GDP grew by 4.8 percent in 2022, reflecting robust performance of the services sector, particularly transport and storage, financial and insurance, information and communication, and accommodation and food services.

Leading indicators point to strong economic performance in the first quarter of 2023, mainly driven by activity in the services sector and recovery in agriculture. The economy is expected to continue to strengthen in 2023, supported by the resilient services sector and expected

recovery in agriculture.

• Two of the surveys conducted ahead of the MPC meeting—the CEOs Survey and Market Perceptions Survey—revealed improved optimism about business activity and economic growth prospects for the next 12 months. The optimism was attributed to improved weather conditions, which are expected to support agricultural production, easing of inflation, and resilience of the private sector. Nonetheless, respondents expressed concerns about the proposed increase in taxation, rise in electricity and fuel prices, and the weakening of the Kenya shilling.

• The Survey of the Agriculture Sector conducted in the first half of the month, revealed that the prices of key food items had declined. Additionally, respondents expect the supply of most vegetables to increase in the coming months on account of the rains. Nevertheless, respondents identified transport costs, high input costs, infestation by pests, and unpredictable weather patterns, as the major factors constraining agricultural production.

• Goods exports remained strong, growing by 6.6 percent in the 12 months to April 2023 compared to a similar period in 2022. Receipts from tea and manufactured goods exports increased by 11.6 percent and 30.4 percent, respectively during the period. The increase in receipts from tea exports reflects improved prices attributed to demand from traditional markets. Additionally, imports grew by 1.2 percent in the 12 months to April 2023 compared to 21.3 percent in a similar period in 2022, with lower imports of infrastructure-related equipment due to completed projects. Oil prices have continued to moderate from the fourth quarter of 2022.Receipts from services exports increased

reflecting sustained improvement in international travel and transport. Remittances totalled USD 3,985 million in the 12 months to April 2023, and were 0.4 percent higher compared to a similar period in 2022. The current account deficit was 5.1 percent of GDP in 2022, and is projected to improve to 4.8 percent of GDP in 2023.

• The CBK foreign exchange reserves, which currently stand at USD 6,495 million (3.61 months of import cover), continue to provide adequate cover and a buffer against any short- term shocks in the foreign exchange market.

• The banking sector remains stable and resilient, with strong liquidity and capital adequacy ratios. The ratio of gross non-performing loans (NPLs) to gross loans stood at 14.6 percent in April 2023, compared to 14.0 percent in February. Increases in NPLs were noted in the manufacturing, real estate, building and construction, and trade sectors.Banks have continued to make adequate provisions for the NPLs.

• Growth in private sector credit stood at 13.2 percent in April 2023 compared to 11.7 percent in February. Strong credit growth was observed in the following sectors: manufacturing (21.7 percent), transport and communication (18.0 percent), trade (13.7 percent), and consumer durables (13.3 percent). The number of loan applications and approvals remained strong, reflecting increased demand.

• The Committee noted the ongoing implementation of the FY2022/23 Government Budget, particularly the performance in tax revenue collection and the proposed FY2023/24 Budget, which continues to reinforce fiscal consolidation. The disbursement of the recently

approved World Bank Development Policy Operation (DPO) and other external inflows will help improve liquidity conditions in the economy.

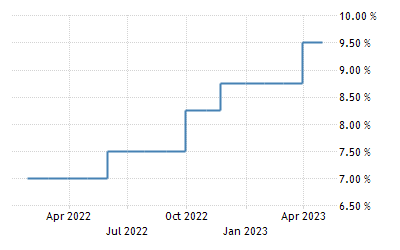

The Committee noted that the impact of the further tightening of monetary policy in March 2023 to anchor inflationary expectations was still transmitting in the economy. Additionally, the MPC noted that this action will be complemented by the recently announced Government

measures to allow duty-free imports on specific food items particularly sugar, which are expected to moderate prices and ease domestic inflationary pressures. In view of these developments, the MPC decided to retain the Central Bank Rate (CBR) at 9.50 percent.

The Committee will closely monitor the impact of the policy measures, as well as developments in the global and domestic economy, and stands ready to take additional measures, as necessary. The Committee will meet again in July 2023, but remains ready to re-convene earlier if necessary.